Mobile payment - the future or just a trend?

It's hard to imagine our everyday lives without the smartphone. It is used not only for telecommunications, but also for streaming music and video, as a source of information, for shopping - and increasingly also as a means of payment. In times of the pandemic, the already rising trend toward contactless and mobile payment has received another significant boost. Even after the easing that has taken place, the smartphone often remains the first means of choice at the checkout. But what about the future of digital payment and what obstacles must be overcome along the way?

What is mobile payment?

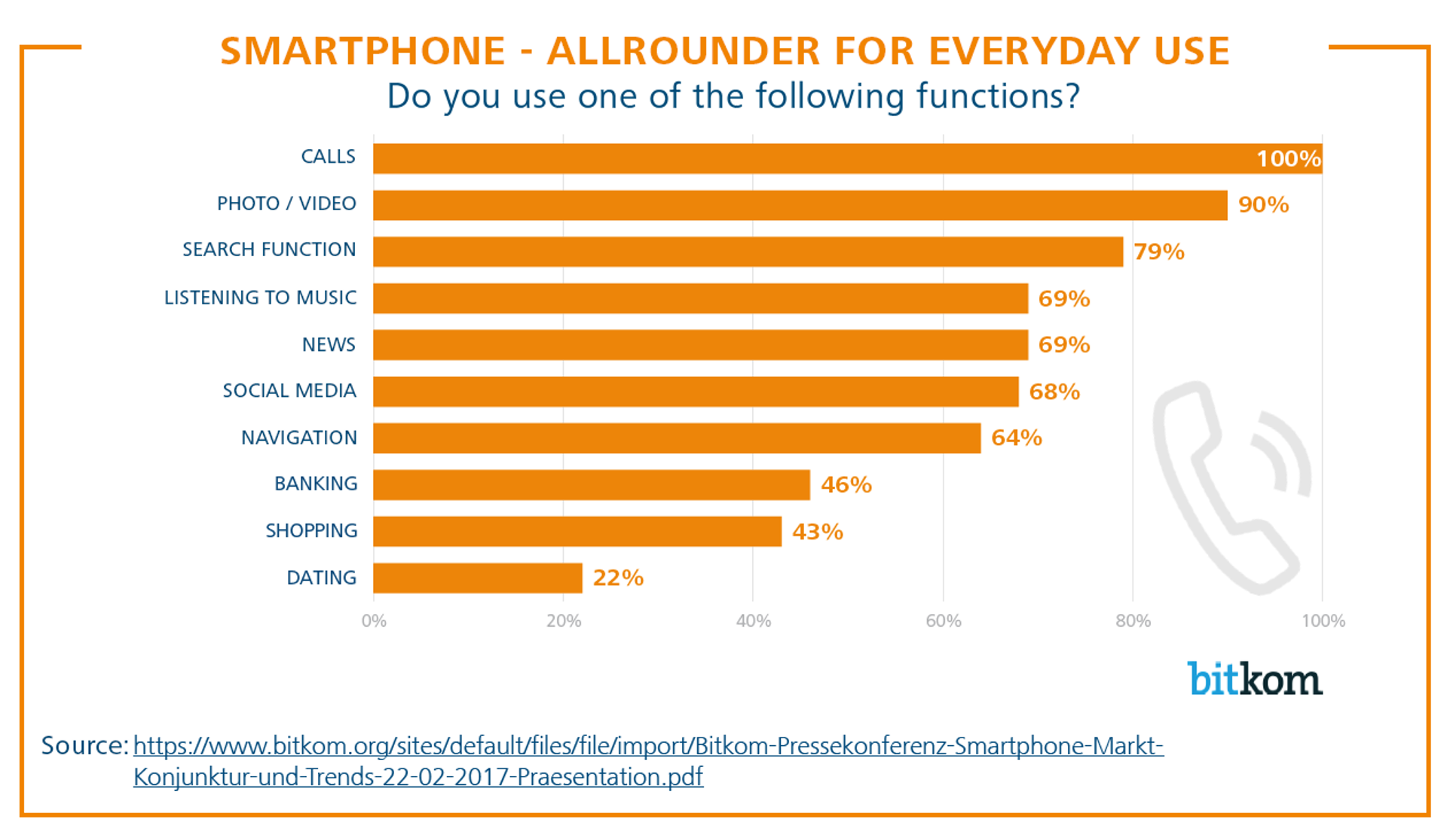

Mobile payment is the contactless and cashless payment through a mobile device (smartphone, smartwatch or tablet) at a point-of-sale (POS). In most cases, the smartphone is used, which is connected to an online payment service during the payment process. The best-known payment apps are Apple Pay and Google Pay. The constant companion thus also becomes a source of payment, enabling users to pay anywhere and at any time. The technology has already advanced to the point that even before the pandemic, 46% of all smartphone users used their smartphone for banking activities.

How does mobile payment work?

Using these services is simple and intuitive. In the app, the user stores the data of his credit or debit card. During the payment process, the user unlocks and opens the selected payment service and holds it up to the card reader. This is usually done by biometric authentication, so that only the user himself can unlock his card. Using the smartphone for payment is practical, hygienic and uncomplicated. In addition, users can easily and quickly track all activities and transactions on their smartphone.

What is the forecast for the future of mobile payment?

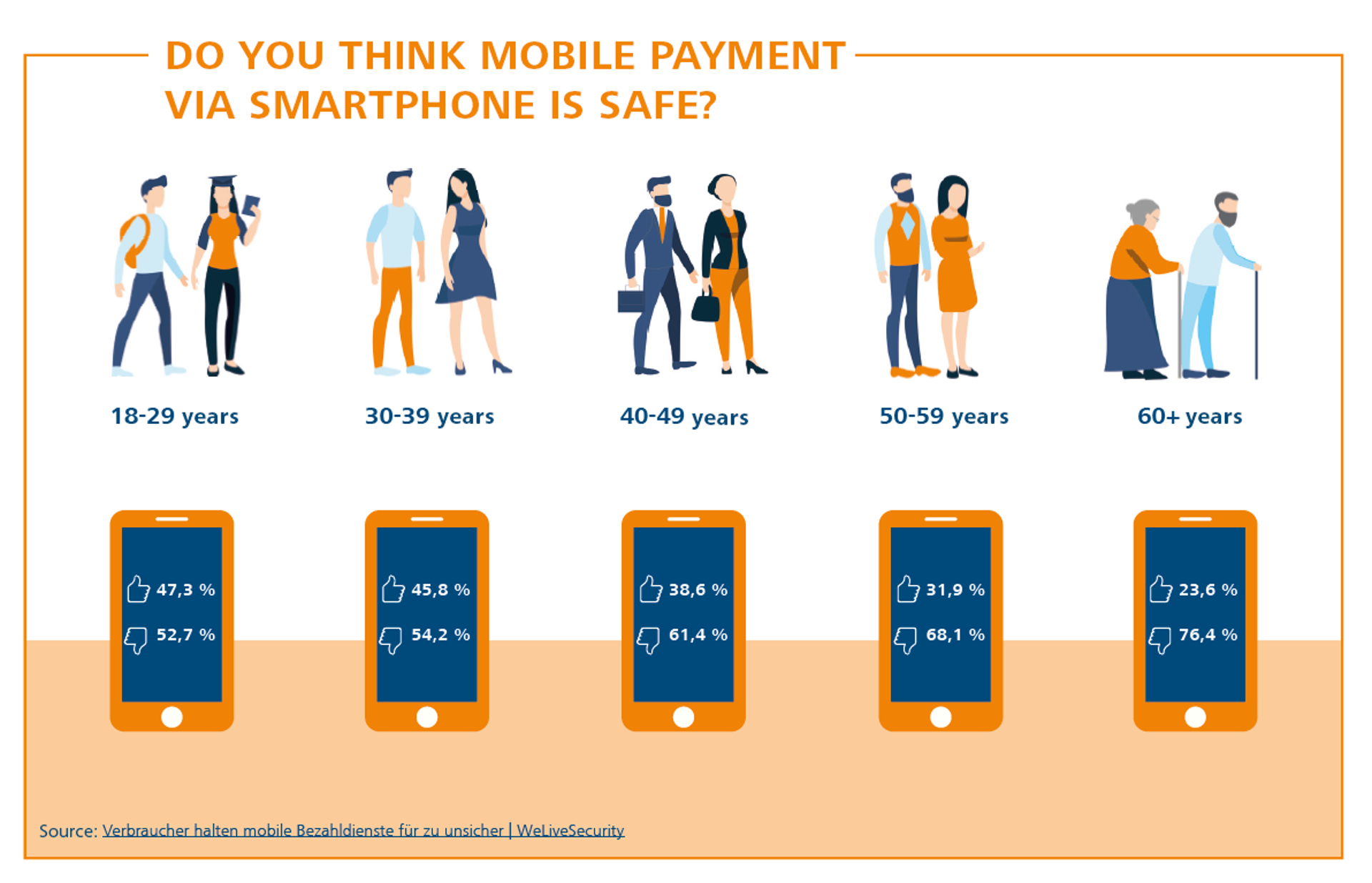

In addition to the growing popularity, there are also concerns about its use. In the eyes of some consumers, security is the biggest question mark about mobile payment. They fear hacker attacks or misuse of the information on the end device. This distrust is more noticeable among the older generation (aged 60 and over). A closer look reveals that these concerns are superfluous, as cyber security and data protection play a very special role in digital payment methods. The security of the user when using the apps is the top priority for the operators, because the consumer should be granted comfort and protection in all processes.

Despite the isolated concerns, the market for mobile payment solutions in Germany is growing steadily - albeit at a much slower rate than in other countries. According to forecasts, the total transaction volume will amount to 41.493 million euros in 2024 (source: Statista). However, according to a recent PwC study, this is subject to the condition that the apps of the mobile payment providers guarantee absolute security. For this reason alone, users can be sure that security is a top priority for providers. The data is certainly sensitive, as linking payment and purchase data with usage and location data allows particularly meaningful user profiles to be created - in the wrong hands, this would be a major threat to data protection and user privacy.

Two factors in particular have played a decisive role in the increasing spread of mobile payment: the development of the smartphone market and acceptance among the population. High smartphone penetration in society - which is undoubtedly the case - is not necessarily synonymous with proportional use of mobile payment services.

According to the Federal Statistical Office, the majority of households in Germany are equipped with a smartphone. Nevertheless, mobile payment currently reaches only a fraction of households. Cash still plays an important role in many transactions. One thing is certain, however: the pandemic has given cashless payment a huge boost in this country, too. In times of the lockdown, contactless mobile payment was considered particularly hygienic - and this view has not changed even after the first relaxations. It is also certain that the smartphone is the constant companion par excellence, especially for the younger generation. It is therefore ideal as a payment medium at any time and any place.

What concerns pose the greatest threat to mobile payment?

Probably the biggest hurdle is the security and privacy concerns associated with mobile payments. What if my cell phone is stolen? Does the NFC chip send uncontrolled data? Can the merchant spy on me? Will I now become totally transparent? In security-conscious Germany, many consumers still fear for their data when they use new digital payment methods. The success of the future technology of mobile payment is therefore essentially dependent on whether Germany is prepared to invest in strong trust-building for broad acceptance in society.

In principle, it should be noted that both in Germany and in Europe, payment by smartphone is at the beginning of its development. But why is the topic of mobile payment already accorded such high prominence? The reason is quite simple: payment with the smartphone fulfills all aspects that are considered important in the future: Speed, digitized content and - influenced by the pandemic - the aspect of hygiene. Mobile payment offers a complete package, giving users the chance to place great emphasis on efficiency and transparency in payment.

The trend in numbers

According to forecasts, half of all Germans will be paying by smartphone in the near future. Of course, this also includes users who will use multiple payment methods. To imagine the dimensions in total numbers, it helps to look at customers in supermarkets. The forecast for 2024 speaks of almost 20 million consumers paying at the checkout using their smartphone.

If we look at current figures, a strong push is expected, especially in the mobile sector. The PWC Mobile Payment Report of 2019 reveals that respondents can imagine regular use of mobile payments in all areas in the future. Whether it's a train ticket, cab ride or airline ticket, just under 40 percent of all users can imagine using mobile payment for payment in the future. However, a look at the international comparison confirms the observation that Germany is still rather reticent in comparison as far as the use of mobile payment is concerned.

A development that is also moving the service station sector. Mobile payments were already made and accepted at around 12,300 service stations in Germany in 2019. During a 2018 survey, 95 percent of all service station owners showed willingness to accept payments with smartphones in the future.

The future of the gas station

This willingness of service station owners to willingly offer themselves as cooperation partners for solutions involving in-car payment services ensures that this market is still at the beginning of its development and will be increasingly expanded in the near future. The more service stations open up to digital payment, the more familiar consumers will become with using this service. Experts are already forecasting exponential growth for mobile payments. Accompanying this development are numerous payment services that are available, including apps that are specifically geared toward payment at service stations.

Traditional payment is no longer a monopoly solution, but one of many alternatives being considered. Consumers are open and ready for new things. Trust in technology and digitization is growing steadily - albeit slowly at first. Nevertheless, there is fundamental trust and mobile payment should not be underestimated or seen as a short-term trend.

In the further development and spread of mobile payment, a large part of the responsibility lies with the mobility service providers, like DKV Mobility. The main task is to make transport efficient and increasingly digital. Digital fleet management, mobile payment and also electromobility are central pillars of tomorrow's transport structure.

Therefore, DKV Mobility continuously expands its mobile payment network. With the APP&GO payment function of the DKV APP customers can already refuel cashless at ~ 2000 fuel service stations in Belgium, Germany, Italy, Austria, and the Netherlands. By this, customers are not only up to date but can also experience mobility in a smart and flexible way.